Subscribe to Our Mailing List

Get the latest news and updates with our Proximity Malt newsletters.

May 12, 2021

May 12, 2021

According to the March 31 Planting Intentions report issued by AMBA (American Malting Barley Association), for 2021, farmers are planning to plant 1% less acreage compared to 2020. While this is a small decrease, the trend is clear: In total, 2021 barley plantings are the fourth lowest acreage on record in the USA.

Looking further into the data, non-traditional regional zones for barley such as Delaware, Maryland, Maine and New York are holding strong. This supports Proximity’s model of regional barley sourcing.

Part of this year’s moderate planting intentions can be explained through the AMBA Barley Stocks report: As of March 1, USDA reported that 2021 stocks totaled 120 million bushels and were up about 4% from the previous March. Most states reported increases in stocks. The exception is Idaho, where Off-Farm stocks were lower than the previous March.

Delaware: The winter barley and wheat crops are showing good progress, as can be seen in the attached photos. Barley is in the heading stage, and with plenty of moisture in both top and subsoil. This should provide good conditions for the filling stage to come.

The Maryland barley crop is listed as 99% fair to excellent (41% in the fair category). The Delaware barley crop is listed as 93% fair to excellent (24% in the fair category).

Colorado: The state remains dry, and a good rain will be very welcome. Barley crop acres are expected to be down this year. However, barley is reported to be well ahead of last year’s planting percentage, with about 66% reported as planted. This compares to 2020 plantings of 26% progress at this time.

With respect to the rest of North America, the major concern is very dry conditions, as can be seen in the attached drought monitor (www.droughtmonitor.unl.edu).

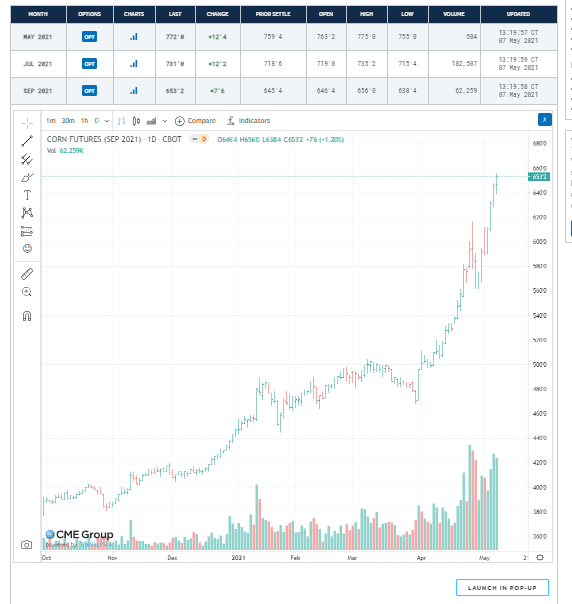

The wheat market is trading over $7.00/bu, already $1.50/bu higher than the market at this time last year. Although barley is not traded on the Chicago Board of Trade (CBOT), it tends to closely trend with both wheat and corn markets.

This is important to note as growers are either in the middle of, or about to get started planting their spring crops. Spring barley competes with spring wheat for acres. So naturally, barley prices will need to increase to keep pace with the current strengthening in the wheat market.

The increase in pricing is across all commodities. It is being driven largely by tight stocks and current weather events – both in the US (dryness in the northern plains & freezing temps through the middle part of the country impacting winter wheat production) and globally (too dry in the EU & Brazil and too wet in Argentina).

A triple-whammy of market forces combine to threaten the availability of malting quality barley. This is developing just as beer sales worldwide begin their post-pandemic rebound. As wheat and corn prices escalate, acres earmarked for barley shift into those higher value crops. High global feed demand (and prices) also creates a stronger channel for feed barley. Third, a dry start to the growing season in key regions worldwide may negatively impact not only malting barley supply, but also quality.

Below are the recent graphs from the Chicago Board of Trade (CBOT) showing wheat and corn futures pricing:

Chicago Board of Trade Chicago Wheat Sept 21 as of May 7, 2021

Chicago Board of Trade- Sept 21 Corn as of May 7, 2021: