Subscribe to Our Mailing List

Get the latest news and updates with our Proximity Malt newsletters.

Minimum Till Winter Barley – March 2023

The 2022-2023 season for Winter Barley in the Mid-Atlantic region is well underway, and so far, the crop is off to an excellent start throughout the region. With temperatures forecast to reach the mid 80’s in the coming weeks, flowering will likely begin in the middle to second half of April for many producers.

April-May is a critical time in the lifecycle of a winter barley plant, where it can be heavily impacted by cold temperatures during flowering. Mid Atlantic winter barley should be free and clear of any damage from cold temps by the middle of May this season.

Along the Atlantic Coast, mild fall and winter conditions have continued into early spring. In this region, the emerging barley crop appears to be maturing at a faster pace, about 7-10 days earlier than typical: By April 7th, some producers in Virginia are beginning to see awns emerge on the edges of fields, while North Carolina producers are seeing full head emergence

Further North on the DelMarVa peninsula, barley is about a week behind Virginia and North Carolina. Overall, barley acres in the region have increased as compared to previous year’s levels, with malting varieties finding a long-term home with growers as a sustainable rotation on farm.

US spring barley plantings will be getting underway in growing regions such as Colorado. Snowpack in the mountains surrounding the San Luis Valley where Proximity Malt is located has been excellent this winter. Acres are slightly up in Colorado. Reports indicate that in Wyoming and the Front Range of Colorado some barley has already been planted.

Whereas the 2022 season in the Valley was dry and windy for the first stages of the crop, producers here are hoping for a slower snowmelt cycle this year, and more normal temps during the initial crop stages. This will promote high tiller counts and a strong stand to carry top end yield potential through into August.

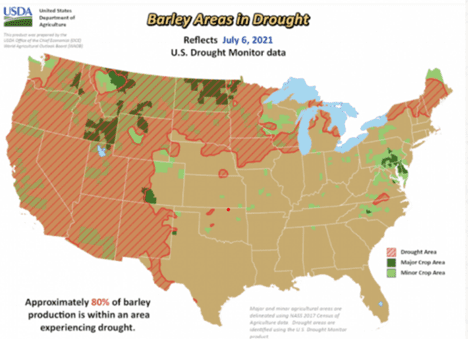

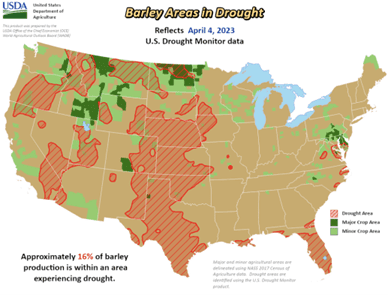

We can celebrate that US barley stocks have mostly rebounded from their low point in December, 2021 driven by the drought-driven crop failure of 2021. Moreover, much of the country’s barley acreage is no longer in high drought-risk areas (see comparative maps below). Still, 2023 barley planting intentions have just barely recovered to pre-drought. 2023 intentions are similar to 2022, which (as per USDA NASS recent report) means procuring quality grain will be crucial, and barley & malt pricing will likely remain firm—and very reactive to weather events that could compromise supply.

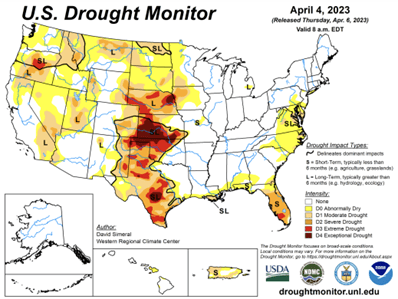

Overall, drought conditions for traditional US barley-growing regions have dramatically improved compared with Early Spring 2022 conditions. USDA Drought maps below, published on April 4, 2023, show that only 16% of barley acres are in areas of moderate to extreme drought, compared with 80% in 2021. For more complete USDA drought data and information, visit this USDA NASS link.

This year’s relatively low stock to use ratio indicates that while the 2022 barley crop made up for lost ground, we are still short of our traditional comfort zone in year-end barley stocks. Barley stored in all positions on December 1, 2022 totaled 114 million bushels, up 17 percent from December 1, 2021—but still lower than December 2020 stocks of 120 million bushels (link to USDA NASS Grain Stocks Report-Barley, pp. 17-19). Additionally, the September – November 2022 barley usage was 52 million bushels, 36% higher than the same period a year earlier.

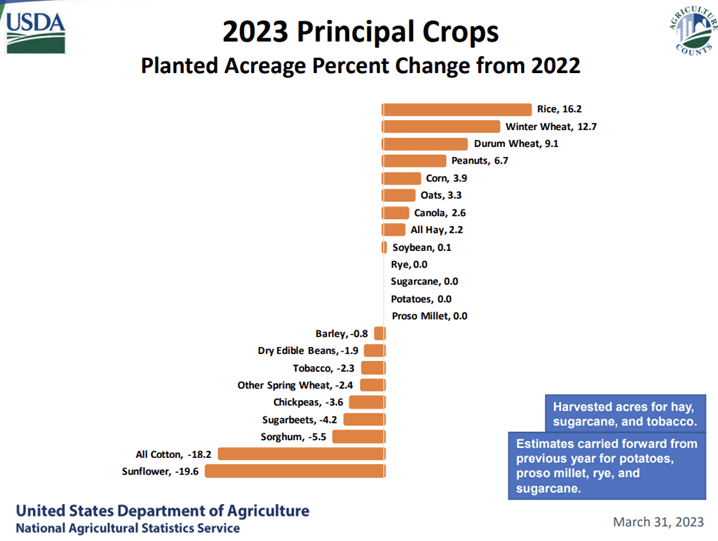

USDA NASS published its annual March 31 planting intentions report, which indicates that US growers will likely plant approximately 3 million acres of barley this year, virtually unchanged from 2022 actual plantings (estimates are for a 1% reduction in acres). By comparison, winter wheat plantings are estimated to increase by nearly 13%.

Reports from Statistics Canada provide an outlook similar to the US regarding crop production and stocks of barley as crop 2023 approaches. A rebound in production beginning in 2022 has partially compensated for the record low carry in stocks following the 2021 drought.

As a result of the expected recovery, demand for both domestic use and exports (with China being the predominant importer) is expected to increase significantly from last year. Carry-out barley stocks from crop 2022 are projected at 0.9 MMT, rising sharply from last year’s record low, but only marginally above the previous five-year average. Canadian barley stocks overall recovered with crop 2022, but they are still 12% lower than the previous five-year average.

Canadian barley area for crop 2023 is forecast at 3.0 million hectares, up 5% from 2022-23 and similar to the five-year average. Supported by expected increases in carry-in stocks, total supply in 2023-24 is projected to be in line with the five-year average.

In talking with some of our brokers in CA, it sounds like a large snowfall and subsequent flooding in the southern portions of Manitoba and Saskatchewan could be a cause for late planting in the Western Prairies.

Expectations are that Canadian barley prices will remain historically high, largely underpinned by strong wheat and corn prices, and robust demand. (Canada: Outlook for Principal Field Crops, 2-17-2023).

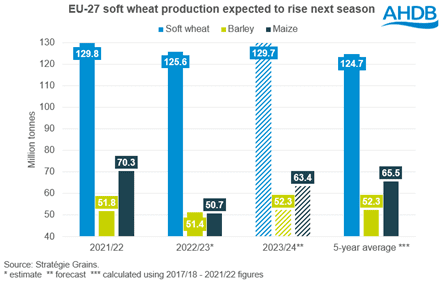

The EU+27+Uk 2023 barley production is forecast at 59.6 MMT, down slightly from the previous forecast of 60 million and slightly up from 58.8 MMT in 2022.

Generally, with a mild start to winter, crop conditions have been positive. However, soil moisture deficits could be a cause for concern moving forward, particularly in regions that experienced severe drought last year. While in Spain and Italy soil moisture is higher now than at the same point last year, in France and Germany, levels are at 6-year lows (Refinitiv).