Subscribe to Our Mailing List

Get the latest news and updates with our Proximity Malt newsletters.

Summary:

A historically inadequate 2021 crop in North America; record-low carry-over stocks; related price increases in crude oil, natural gas & coal pitted against firm global demand for both feed and malting quality barley – all give rise to higher raw material costs in malt production. Indications from growers and the grain commodity market are that these factors will carry over into 2022 pricing, and perhaps beyond that.

The short supply of malting quality grain in North America creates incentive for commercial malting and brewing companies to import needs from EU and Australia to fill supply gaps until 2022 crop is harvested.

Important to note, the combination of historically high wheat prices and projected record low ending barley stocks have compelled the malting and brewing industry to offer barley contracts to growers at 40-50% above recent price levels to increase acres, replenish barley inventories and work to reestablish a supply-demand balance.

The American Malting Barley Association (AMBA) reported last week that overall barley production in the US is down 31% to 2.6 million tons (MMT) from the 2020 total of 3.7 MMT. The average yield per acre was down nearly 22% over last year’s. The poor harvest results were due to excessively hot and dry weather patterns in many regions throughout the growing season.

Making the situation even more precarious, US barley stocks on September 1, 2021 are 25% down from the same date, 2020.

All wheat production totaled approximately 45 MMT in 2021, down 10 percent from the 2020 total of 50 MMT. Oat production was estimated at a record low of 0.614 MMT, down 39% from 2020.

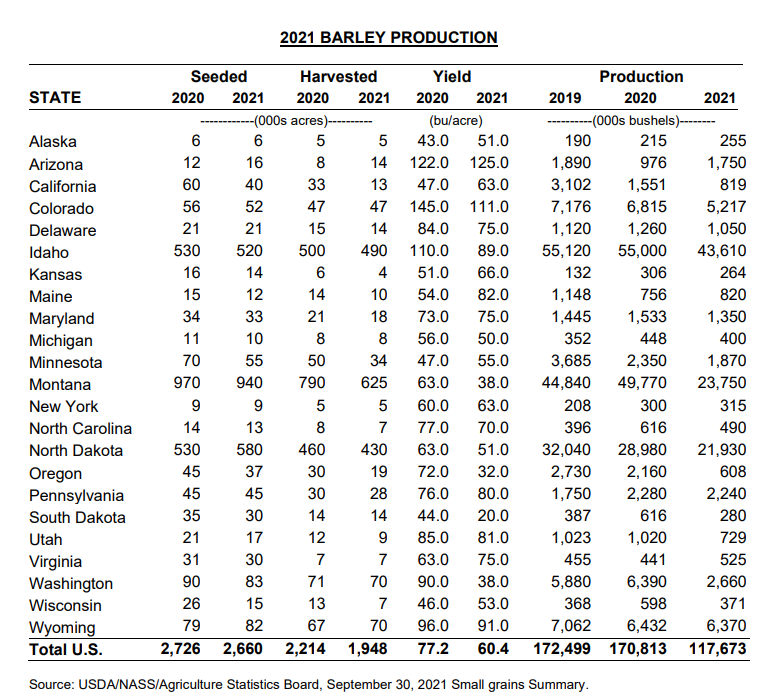

US Barley Production, USDA-NASS-Agriculture Statistics Board, 9/30/21:

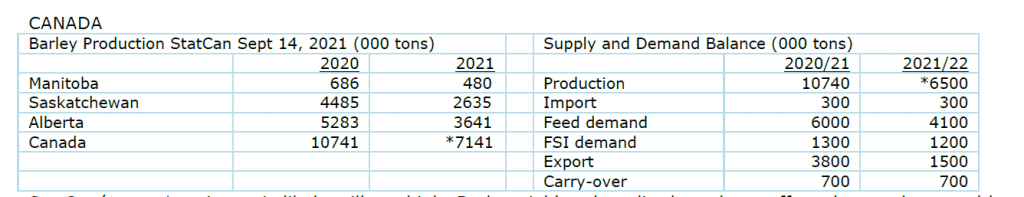

Statistics-Canada estimates Canada’s barley production at about 7.1 MMT – a 31% drop over last year, and the lowest production in seven years. Some industry experts express doubt that the final crop will reach even this level. Barley stocks are forecasted to fall 33%, to 8 MMT, a record low.

Elevated proteins related to the dry conditions will compel the malting industry to relax their barley protein specifications, in order to fill demand.

Harvest rains across much of the US and Canadian prairies has created pre-sprout conditions in some regions, which will impact germinations as well as safe storage of grains across the industry. Overall shortages of malting-quality barley has the North American industry looking at imports from the EU and/or Australia to fill supply gaps until the 2022 crop is harvested.

European barley crop results were better than North America, but fell short of mid-season estimates due to challenging harvest conditions. Yields per acre and test weight average are lower than average years, and overall quality combined with unusually high export demand for feed and malting quality will put pressure on maltsters to lower their expectations for parameters such as protein and plumpness.

With a solid crop underway, optimistic weather predictions and a 30% increase in planted acres, expectations are that Argentina will become a top supplier of malting and feed barley to China in the new crop year, as Australia is still embargoed there. Argentina also continues to ship substantial quantities to their South American neighbors.

With estimates for a healthy harvest approaching 13 MMT, Australia has ramped up non-China malting barley exports in several South American countries.

Both Argentina and Australia look to be in strong positions to take advantage of export opportunities throughout the global feed and malting barley trade, as the supply-demand imbalance continues to play out.

Pictured above: Derek Heersink, Square Peg Brewery Co-owner and Barley Grower, Monte Vista, CO

As can be derived from the above US production chart, Colorado seeded slightly less, but harvested the same total acreage of barley in 2021, compared to 2020. Overall in Colorado, yield and production were both down approximately 30%.

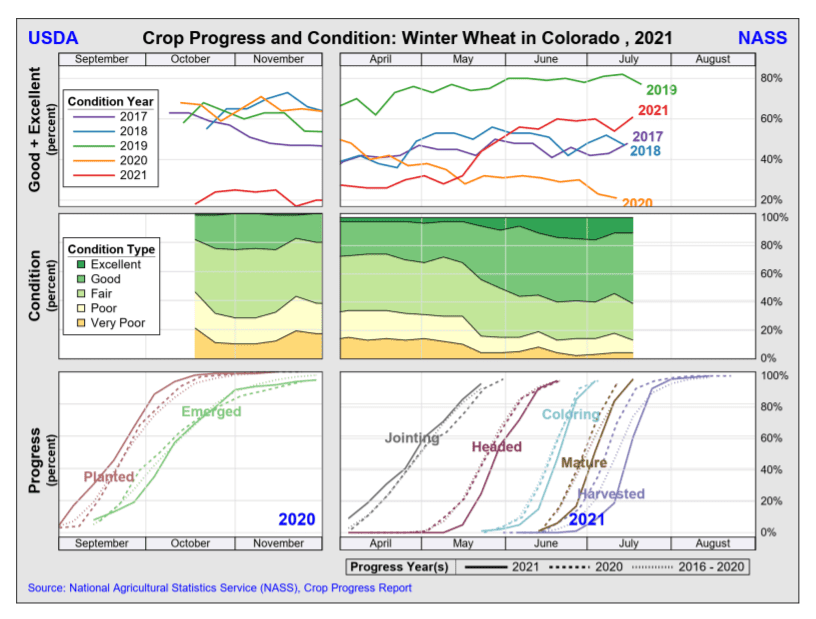

The graphics below, also from USDA-NASS, illustrate the impact of weather on barley and wheat quality in Colorado – with the Good/Excellent category dropping dramatically in barley, and less so in winter wheat when compared to the last four years. As with our winter 2-row barley crop in Delmarva (see below), winter crops (wheat and barley alike) harvest months earlier than spring crops, thus avoiding weather risks that can materialize in late harvest months of August-October.

In the San Luis Valley (our primary source for barley and wheat), we saw better than average grain quality compared against other Colorado and North American results. We did see the impact of high temperatures and hail that resulted in lower-than-average test weight and plumps. From the samples we have seen, protein is up this year averaging close to 11, test weight down averaging around 49, plumps are closer to 90 than 95 in the past.

As summarized in the mid-season crop report, the Delaware-Maryland-Virginia (Delmarva) region’s two row winter barley crop was safely in the bins before excessive heat, dryness and badly-timed rainstorms scuttled much of the North American northern tier barley crop. Early harvest and avoidance of high-risk growing months is one of the primary benefits of two row winter malting barley varieties.

Yields from the winter barley crop were average, proteins were slightly higher: we expect a range of 10.5-11.5 this year. Test weights were down slightly compared to last year, which could correspond to lower extract levels. We are beginning new crop malt trials, and will see preliminary results in the next couple of weeks.